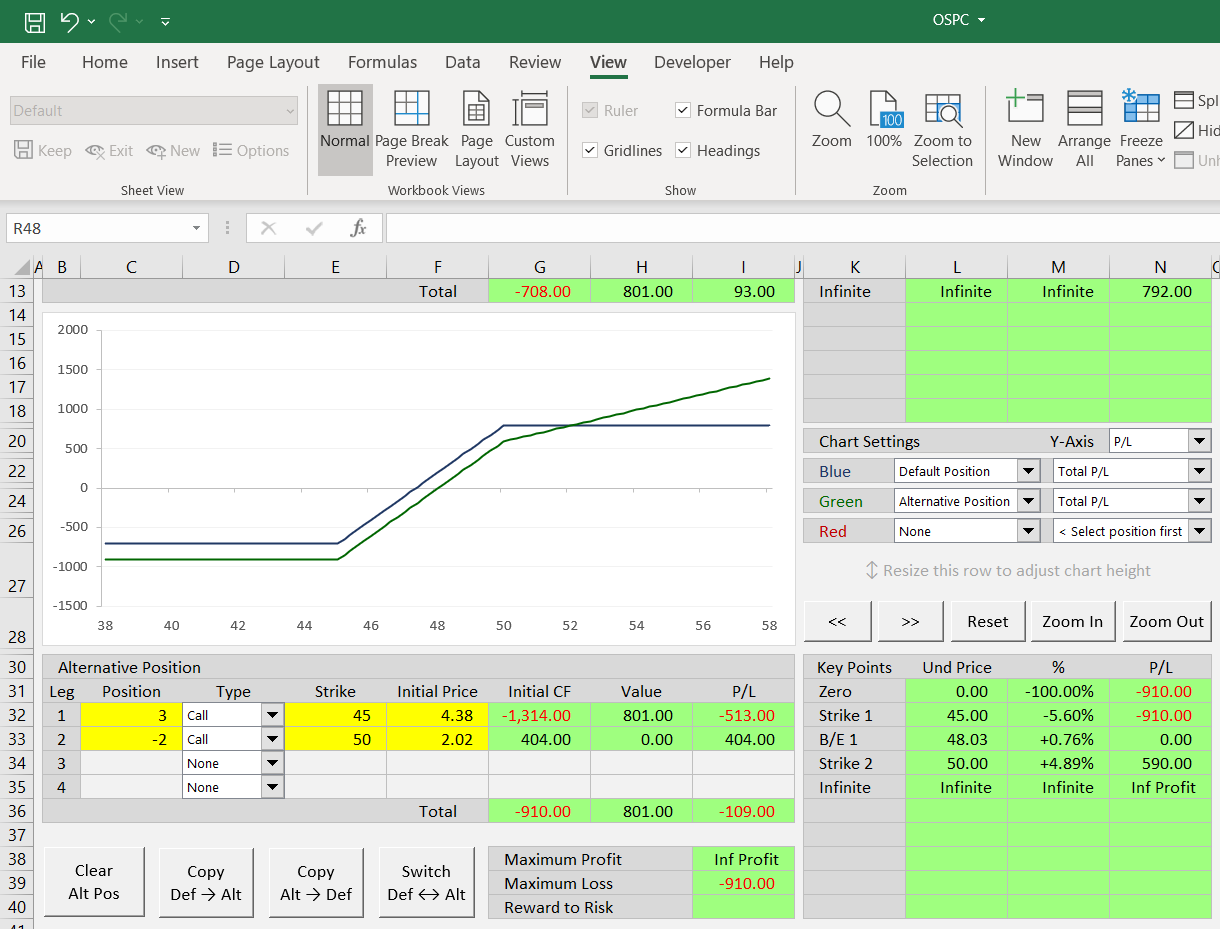

22+ Option Spread Calculator

The goal is for the stock to be above strike. Enter the maturity in days of the strategy ie.

Is Healthcare Affordable To Everyone In India

One example would be Treasury products.

. This debit spreads potential profit would be 2240 140 x 16 if XYZ is above 42 at expiration. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Underlying Price 0 100000 Strike Price 0 100000 Volatility 0 250 Interest Rate 0 10 Dividend Yield 0 20.

Select your option strategy type Call Spread or Put Spread Step 2. Buy call at 150 with next months expiration. A neutral to mildly bearishbullish strategy using two calls of the same strike but different expiration dates.

70 credit for the 3Yr 2Yr at a. What is a calendar call spread. The component of the call spread is as follows.

If the stock is near strike A when the earlier call. Strategy Calculators Call Option Purchase Put Option Purchase Profit Guard Stock Call Option Spread Put Option Spread Profit Guard Option Buy Write Analysis Equity Growth Call. 70 credit for Ultra Long T-Bond 30Yr 10Yr 5Y at a ratio of 2235.

Strategy Calculators Call Spread Calculator A call spread or vertical spread is generally used is a moderately volatile market and can be configured to be either bullish or bearish. Sell call at 130 with next months expiration. Enter the underlying asset price and risk free rate Step 3.

22 Option Spread Calculator Minggu 15 Januari 2023 Web Basic Options Calculator. This basic calculator describes step by step all of the input parameters used to price an option underlying price strike price expiration date volatility. The Option Calculator can be used to display the effects of changes in the inputs to the option pricing model.

And dont forget those transaction costs. The inputs that can be adjusted are. Option value calculator Calculate your options value.

It combines a long and short call which caps the upside but also the downside. Strategy Calculators Call Option Purchase Put Option Purchase Profit Guard Stock Call Option Spread Put Option Spread Profit Guard Option Buy Write Analysis Equity Growth Call. The entry price being 1 the options contract is.

A bullish vertical spread strategy which has limited risk and reward.

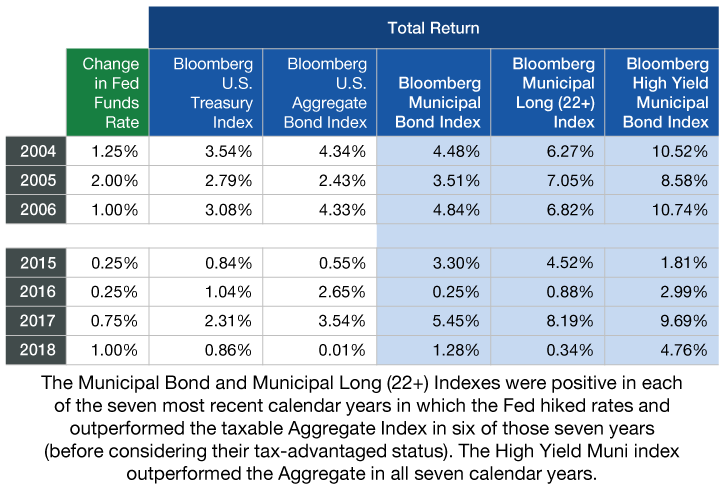

Municipal Bonds And Rising Rates 3 Considerations For Investors

Dat Scores What Is A Good Dat Score

Lowest Spread Forex Brokers In Singapore 2023 Updated

Ac2 1solnmanual Pdf Pdf

Modeling Of Spin Crossover In Iron Ii Complexes With N4s2 Coordination The Journal Of Physical Chemistry C

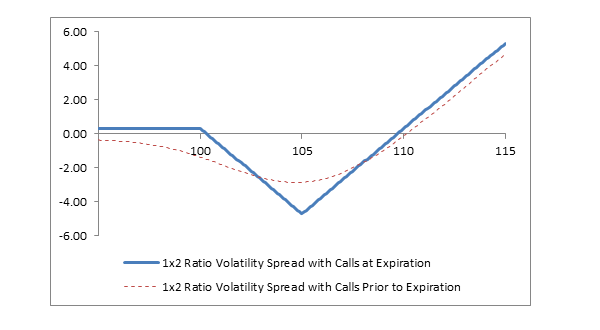

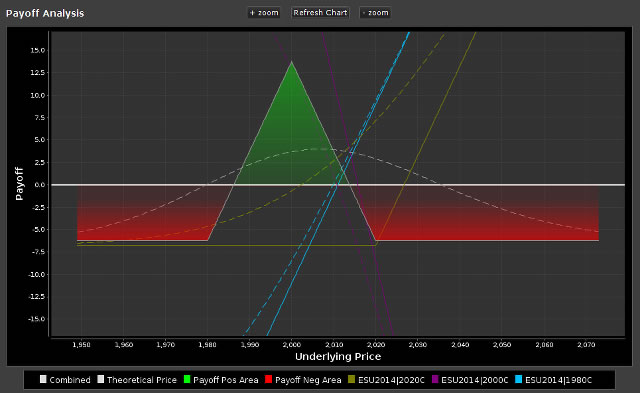

Ratio Spread The Options Portfolio

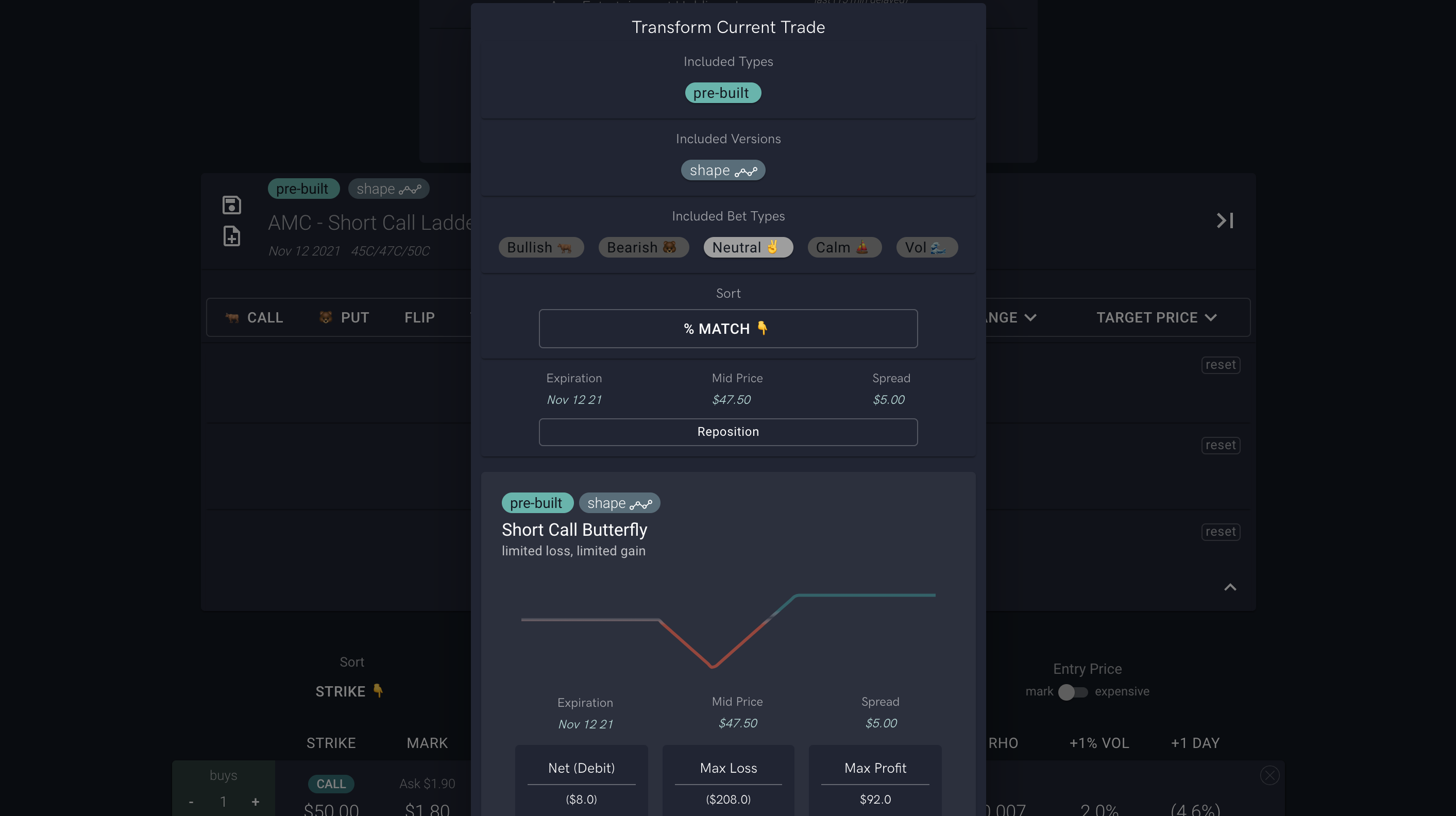

Options Calculator

1x2 Ratio Volatility Spread With Calls Fidelity

Unreal Engine 5 0 Release Notes Unreal Engine 5 0 Documentation

Constructing A Put Option Ratio Spread Carleygarnertrading Com

Stock Market Math Essential Formulas For Selecting And Managing Stock And Risk By Michael C Thomsett 9781501515811 Booktopia

Icicle Climb Trek Ski Run Inspirational Mountain Adventure Holidays

Workbook Fw21 22 By Picture Organic Clothing Issuu

22 Effective Customer Retention Strategies For Ecommerce

Options Profit Calculator Opc

Bull Call Spread Option Strategy Payoff Calculator Macroption

Barchart Trader Options Price Calculator